Phoenix criminal attorney is a reputed law firm that specializes in handling white-collar and fraud criminal cases in Phoenix, Arizona. The attorneys in the firm have been defending clients charged with forgery, including check fraud for years and have the best resources and knowledge to fight for your rights.

Forgery can be done in several ways, and under Arizona law, all forgery charges carry severe consequences and a person committing a forgery crime will not be tolerated by state prosecutors. Check fraud, counterfeiting, identity theft, and other similar criminal offenses have been meticulously investigated by both prosecutors and police officers. Consequently, people charged with forgery, mainly check fraud in Phoenix, Arizona may face imprisonment, a lengthy jail term, huge fines, significant periods of probation, and restitution.

If you are facing a forgery charge or under investigation, it’s essential to seek a consultation from an experienced Phoenix criminal attorney who has a sound knowledge of white-collar crimes and rich experience of defending forgery crimes of all severities.

What is Check Fraud Under Arizona Law?

Check fraud involves the issuing of forged, faked, and deceptive checks to make a purchase, finance a transaction, initiate a fund transfer, or acquire account funds from a banking institution. A lot of times, check fraud occurs when the account holders issue a check knowingly that they don't have sufficient amount in their bank account to pay for that check. This is a severe criminal offense, and it can cause an individual to have a criminal record registered against his name, which can be very upsetting and embarrassing for someone who never had a criminal record in the past or someone who has had low-level criminal offenses on the record in the past. Not only individuals but businesses, both large and small alike can also face criminal check fraud charges. Some common examples of check fraud include:

- Forgery – using a fake ID or signature to authorize a check

- Counterfeiting – printing duplicate checks

- Paperhanging – Intentionally writing bad checks from a bank account that has been closed

- Check kiting - it is a prevalent white-collar crime that involves writing a bad check from a bank account having inadequate funds and depositing it to another bank account. Then, withdrawing the amount from that second bank account before the original check that has been presented gets cleared.

There may be forgery cases in which check fraud is purely unintentional or accidental. For example, Mathew checked his bank statement recently and issued a check for an amount more than what was present in his account. By doing so, Mathew has unintentionally committed check fraud. In such cases, the bank will ask Mathew for the money due, and fine will be levied on him for writing a check over his balance. If he makes the payment on time, there will be no further problems.

In Arizona, an individual should be aware of issuing a bad check for fraud to be committed; the check fraud must not be intentional. To control the criminal check fraud, some regulations were laid out by the Arizona Revised Statutes, 13-1807 through 13-1811.

The Revised Statutes

According to the current law in Phoenix, Arizona, check fraud is considered a criminal offense only in the case when the defendant was familiar with their deception. Today, there are numerous possible defenses available, which protect the accidental offender from the legal conviction. For instance, if the person who is about to receive the payment is informed by the accused that there are not enough funds available in the account and ask him not to present the check for cash, in such a case, a check fraud criminal offense has not been done. As the defendant made it clear to the recipient about insufficient funds in the account, it's clear the misconception that the accused was trying to do check fraud. Likewise, if the defendant wrote a check when enough funds were present in the account, or the insufficiency of funds occurred owing to an unexpected bank action or a bank error, the accused is not accountable for fraud.

These statutes are helpful to those who have been found guilty of criminal check fraud. There are numerous ways listed in statute 13-1808 to find out that the defendant intentionally attempted to defraud the recipient of the check. For example, if the defendant writes a check against a closed account, it can be presumed that the defendant knew that the check was bad. Similarly, if the defendant fails to make the payment within a set period, knowledge of insufficient funds in the account is assumed.

If a defendant intentionally commits check fraud, the recipient of the check may claim double the amount of the original check-in compensation. Furthermore, the defendant will have to pay attorney fees, court fees, plus the penalty amount for writing the bad check (13-1809).

Punishment for Check Fraud in Phoenix, Arizona

If a person is knowingly writing a bad check, he is bound to face the punishment for check fraud. However, the severity of the sentence depends upon a large number of factors. For example, writing a bad check for an amount less than $5,000 is classified as a class 1 misdemeanor, and it carries the following punishments:

- Up to six months in jail

- Fine from no money at all to $2,500 with surcharges of up to 84%

- Community restitution

- Probation

If the check amount is $5,000 or above, and the defendant fails to repay the total amount within 60 days, it is considered a class six felony. In Phoenix, Arizona, a class 6 felony carries a one-year jail sentence or 4 months to 2 years in prison. One prior offense could result in up to 2 ¾ years in jail. Two previous criminal check fraud could result in up to 5 ¾ years in prison.

Statute of Limitations for Writing a Bad Check in Phoenix, Arizona

Just like any other state in the U.S., Arizona has its own law of limitations for writing a bad check. For prosecuting a class 1 misdeed, ARS 13-107 implies a 1-year law of constraints, while for prosecuting a class 6 felony, there will be a seven-year law of limitations. It is important to note here that you may be accountable for a civil case even when the applicable law of limitations terminates, but the criminal charges against you would be dismissed. The law of limitations initiates only when the crime is found not actually when the offense happens.

If you have issued a bad check, you need to make every possible effort to get in touch with the recipient of the check as early as possible and give him a valid reason why the check was dishonored. Otherwise, the recipient may turn to the attorney for collection and potential criminal prosecution.

General

Under ARS 47-4404, a banking institution is not liable to pay a check for older than six months. You may not be at fault if the problem arises because someone did not timely present a check. However, you may be criminally or civilly liable, depending on the circumstances and facts.

Civil Law

Apart from the possible criminal prosecution, the issuer of a bad check can be held civilly accountable. If a dishonored check is not paid within 12 days of the date of a notice of dishonor, the defendant will owe to the recipient of the check an amount equal to double the amount of a check, or an additional $50, whichever is greater, plus court fees and attorney fees.

As per ARS 47-3118 (C), the recipient of a bad check needs to file a civil case within three years from the date of a notice of dishonor, or 10 years from the date mentioned on the check, which ends first. A check is legally a "draft."

What Reasons Will Support a Criminal Prosecution for the Dishonoring of a Check

The banking institution can dishonor a check for one of two reasons:

Lack of funds: The check is presented or deposited for payment within 30 days from the date issued, and the defendant has been unsuccessful in making payment along with a service charge after getting a formal courtesy notice that the check has been dishonored.

No account/Closed account: This depends on the status of the bank account at the time the check was written, not at the time it was deposited to the banking institution for payment.

There could be many other reasons why the bank dishonored a check. However, the purposes listed down in the statute will support a legal prosecution. If a check has been dishonored for any other reason, it's wise to check the availability of civil remedies for writing bad checks.

Possible Check Fraud Defenses in Arizona

An experienced attorney having rich experience in handling criminal check fraud will assist you in crafting a strong defense based on your unique case. Listed below are some possible defenses when you face a bad check or check fraud lawsuit:

- You were in the state of intoxication when writing the check

- You formally informed the bank about insufficient funds with a promise to repay, thus creating a temporary credit extension.

- The lack of funds was due to the banking institution, making some adjustments to your account without informing you.

- There were prior successful dealings between you and the recipient of the check

- Upon receiving the notice of the bounced check from the bank, you quickly paid the total amount in question, along with interest.

- Another party’s illegal activity resulted in the check fraud

- You had demonstrated good moral character

- You had no idea or unaware of that the check would not be honored

- Before drawing the check amount, the recipient was formally informed that you didn't have sufficient funds in the account.

The Bad Check Program

In the last few years, check fraud has been rising in the state of Arizona, and it has become a severe problem. Even the most careful individuals, organizations, or businesses receive bad checks. With the rising check fraud, it becomes important that individuals or businesses that accept bad checks know how to deal with the problem. The bad check programs in every state of Arizona help businesses and individuals recover funds from bad check writers. Generally, attorneys run these programs.

A bad check qualifies for the program if it contains one of the following features:

- The check amount does not go beyond $5,000, and multiple checks do not exceed this limit.

- The complaint should not be submitted before 31 days to the bad check program after the check was issued and not after 90 days from the check's date.

- The bad check issuer must receive the courtesy notice offering ten days to pay the total amount written on the check.

Listed below are the following reasons for which a check may not qualify for the program.

- The bad check writer’s identity is not known

- The check is stolen

- The check does not bear any signature, date or amount

- The banking institution has not processed the check

- The check is post-dated, or it has been converted to cash

- It is a payroll, rent, government-issued, two-party, stop payment or traveler’s check

Some Tips To Keep In Mind When Accepting Checks:

- The recipient should never accept post-dated checks

- The recipient should never accept a check having mismatched names, typos, spelling mistakes, or overwriting issues.

- The recipient of the check should ask and write the check issuer’s contact number, driver’s license number, or any other vital information on the check.

- Carefully check for changes, modifications or additions to the issuer’s name

- Never accept the check when in doubt

- Establish a check acceptance policy

- Before accepting any check, the recipient should insist on proper identification

- Always look at the check vigilantly, and be cautious of those that have lower figures

- No organization or business will give you a check for an extra amount and ask you to send the remaining balance back to the organization or some third-party. Be careful of any such fraudulent check you receive from anyone and never accept a check with an amount more than you are owed.

- Always remember that sometimes counterfeit checks have a company's actual account number. When you are in suspicion, it’s wise to call the company outrightly to verify the check using the telephone number available on the internet. Never call on the number that is available on the check for verification.

What You Need to Do When You Receive a Bad Check

When an individual receives a bad check, he should inform the check writer or issuer. The recipient of the check must request the total amount in reimbursement. If the check issuer doesn't respond to the request of the recipient within ten days, another courtesy warning must be sent. If the check issuer still does not respond in 10 days, the check must be immediately sent to the bad check program along with a plea for a thorough investigation. As soon as the bad check program sends the investigation report, the recipient must fill out some additional forms and submit it along with the bad check and notification documents. Once done, the program will assist the check recipient in going through the rest of the process.

What Information Should You Bring to The Court to Begin Prosecution?

It is advised to bring with you an original check, a photocopy of the bad check (front and back), the mail receipt of courtesy notice and any other information you have issued related to your efforts made to collect the check.

Find A Phoenix Criminal Lawyer

If you have been charged with any form of check fraud, particularly if you are facing a felony charge, it is wise to seek a consultation with a criminal defense attorney in Arizona. Not to mention that you are at risk of facing criminal penalties such as prison, jail, fines, probation, restitution, and more. You could also lose your reputation and barred from increment, job promotion, or even from your dream job. An experienced attorney may not only reduce the charges against you but also negotiate for the most favorable outcome on your behalf.

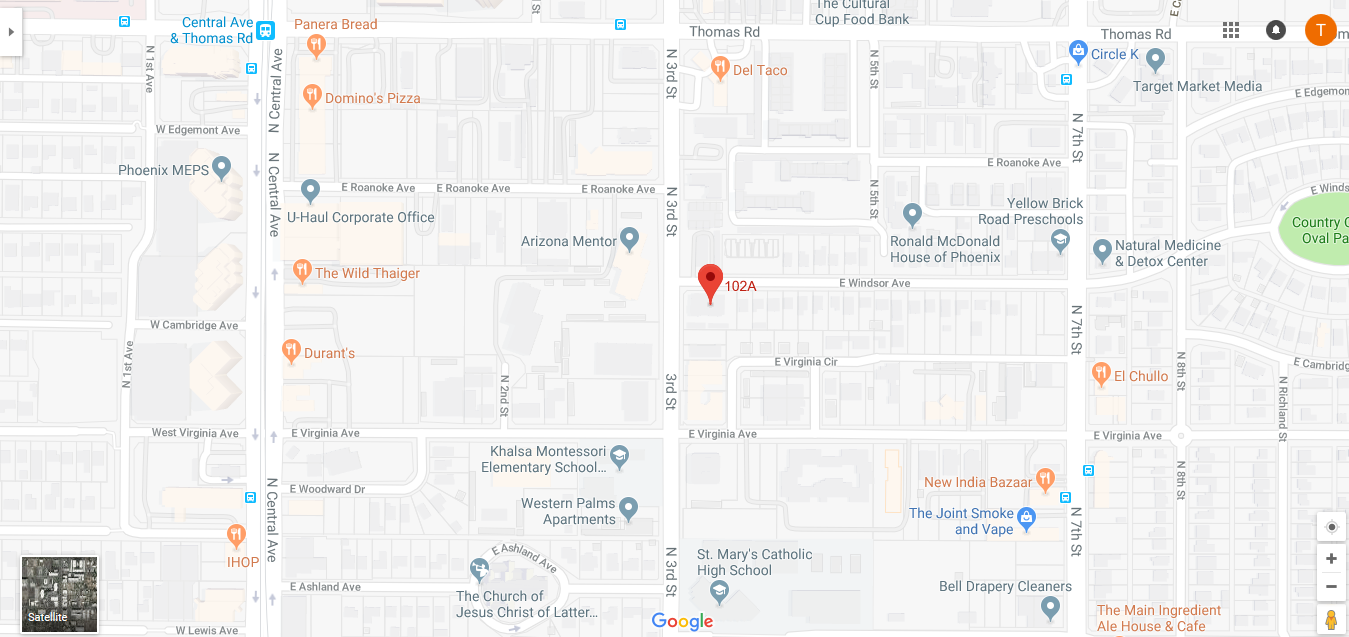

Phoenix Criminal Attorney is a proficient law firm that practices check fraud criminal defense in Phoenix, Arizona. We are dedicated to providing honest legal advice and work diligently on your behalf to resolve even the most complicated criminal cases. Our firm treats every case with a personal approach and gives the attention it deserves. Moreover, we stay updated with all penal laws in Phoenix, Arizona, and have a proven track record of success in handling check fraud cases. Give us a call at 602-551-8092 and discuss the details of your case. We will explore all the angles and find out the best possible outcome for the criminal charges filed against you.

An individual needs to note that civil lawsuit entailing criminal check fraud offense can be managed without hiring a lawyer in small claims court. However, in civil cases where the amount exceeds $3,500 (the standard limit for small claims court), it is wise hiring a lawyer to handle your case in the court. Hiring a professional and experienced attorney can settle the check fraud lawsuit outside of the court premises for an amount less than the claim amount, thus saving you money and time.