Phoenix criminal attorney is a highly reputed criminal defense law firm that serves the clients accused of/or charged with insurance fraud in Phoenix and throughout the state of Arizona. The highly experienced legal counsel for the firm has a proven record of successfully representing insurance fraud cases and works diligently to bring the most favorable outcome for the criminal charges levied against their clients. The attorneys for the firm will aggressively represent your insurance fraud case and guide you throughout the trial to defend you from the severe penalties and criminal prosecution.

If you have been charged with a health insurance fraud, car insurance fraud, or any other white-collar crimes in Phoenix, Arizona, you may face serious consequences, including a possible felony conviction. Thus, it becomes essential to seek a consultation from an experienced defense attorney who is well-versed with insurance fraud criminal laws in Phoenix, Arizona. An experienced attorney addresses not only your concerns, but also fights for your rights, and ensures that you feel confident throughout the trial.

What is Insurance Fraud Under Phoenix, Arizona Law?

Insurance fraud occurs when information regarding premiums, insurance claims, or applications is falsified by individuals knowingly to deceive an insurance agent, company, or another person to acquire money for which they are not legally entitled. It can also happen when a person makes multiple claims from the insurance company for the same injury or if someone intentionally does a traffic collision and overestimates the damages with an intent to obtain a larger claim settlement improperly. Another typical example of insurance fraud is arson, in which a person knowingly burns one’s shop, home, or office. The person who intentionally burns his property later files a claim to the insurance company describing arson as an accident, to receive a higher insurance payout. The thing that needs to be noted here is that a person who commits the act of arson to receive insurance benefits may be convicted for both arson and insurance fraud. In the state of Arizona, any crime committed with an intent to deceive an insurance company constitutes insurance fraud.

Though insurance fraud is presumed as a victimless crime, you would be astonished to know that the estimated losses from this criminal offense exceed $100 billion every year. That's why 10% of all kinds of insurance claims are suspected to be fraudulent. Today, insurance fraud is on the rise and is committed by people from different backgrounds of society.

Insurance fraud is classified into two groups: "hard" and "soft":

Hard Fraud: In this, an individual intentionally fakes an injury, accident, arson, theft, or any other loss to collect money fraudulently from insurance companies. Generally, the defrauder acts alone, but over the last few years, an organized crime surrounds large schemes that steal hundreds of thousands of dollars.

Soft Fraud: In this type of fraud, honest people tell some "little white lies" to their insurance agency, thinking it's a harmless fudging. However, it’s a crime that increases the insurance costs of everyone.

Types of Insurance Purchased by People

To get a clear picture of insurance fraud, it becomes essential for you to know the concept of insurance, i.e., why an individual buys the cover and how it works. Generally, people purchase insurance policies to protect themselves from unexpected harm or loss. The policy is bought from an insurance agent or a company. It is a mutual collaboration in which the insured or a policyholder agrees to pay a certain amount to the company on a yearly, quarterly or monthly basis and in exchange, the insurer agrees to compensate the insured person for the unexpected harm or loss. The common types of insurance available in the market include accident insurance, health insurance, and more. Accident insurance is helpful in case of events that cause injury, harm, or monetary loss. Such events comprise house fire breakout, auto accident or substantial damage to property due to natural disasters like floods, earthquakes, etc.

On the other hand, health insurance is helpful to protect yourself from life-threatening ailments, such as the development of tumors, tuberculosis, Alzheimer's, diabetes, stroke, and many more. People also purchase it for services that they know they will avail. The services include annual health checkup, routine checkups, and other preventive care.

How Is Insurance Fraud Detected or Investigated?

Insurance fraud crime is on the rise, and it has a significant impact on the economy of a nation. When an insurance agency or company is defrauded, the insurer tries to recover the amount by increasing the costs of the premiums or policies. Due to the rising insurance fraud and the impact of fraud on the economy, many states in the U.S. have well-established fraud departments or bureaus that are dedicated to fraud investigation and detection. Many of these departments are law enforcement agencies that can send a suspect for legal prosecution.

Types of Insurance Fraud in Phoenix, Arizona

In Phoenix, insurance fraud can be done in several different ways, including:

Auto Insurance Fraud: In this, a person fabricates or exaggerates the claim amount to get a higher amount from the insurance agency for their vehicle.

Casualty Fraud: In this, a person tries to obtain the life insurance amount from the insurance agency by fabricating his death or death of another person who has bought a life insurance policy.

Worker’s Compensation Fraud: In this, a person tries to obtain multiple claims for the same injury or fabricate an injury with an intent to receive the insurance amount.

Property Fraud: In this, a person fabricates the existence of items stolen during a robbery or exaggerates the value of items damaged in an accident or even destroys his own property to receive the insurance payout.

Medical Billing Fraud: Medical billing fraud can be done in several ways like billing for services that are not insurance billable but renamed so that they can be billed. For instance, a plastic surgery "nose job" is not covered by the insurance, but when it is renamed as a deviated septum, it's a billable procedure. Upcoding is another common medical billing fraud in which you receive a service but are billed for a costly service than the one actually performed by your doctor. For example, you get the treatment for a common cold, but your medical practitioner may bill for pneumonia. Besides this, medical billing fraud is also done when they charge for services that did not even provide or charge patients for services more than their medical insurance amount. This is generally referred to as balance billing.

Unemployment Fraud: In this, a person tries to receive unemployment insurance benefits even after return to employment. Generally, many individuals work part-time (temporarily) but do not report their earnings during filing of an insurance claim, thus obtaining unemployment insurance benefits for which they are not entitled. Under A.R.S. 23-771, a person can only receive unemployment benefits if:

- He/She is actively searching for a job

- He/She is fit and able to work

- He/She has enrolled for work

- He/She has filed a claim for benefits

- He/She has got some amount of income for at least a couple of months before becoming employed

Under A.R.S. 23-785, intentionally making a misleading or false statement with the purpose to receive unemployment benefits is a punishable offense in Phoenix, Arizona as a class 6 felony. A person charged with unemployment fraud may have to face two years of imprisonment in jail along with fines up to $150,000 for making each misleading or false statement.

Health Insurance Fraud: In this type of fraud, an individual or a company defrauds the government or private healthcare programs, particularly health insurance companies, providers or individuals by intentionally submitting misleading or false information with the purpose to receive the unauthorized benefits. This fraud can be done by using fake insurance cards, stolen health information or supplements, medications, or other pill mill practices.

False Reimbursement Claims: In this, a person fabricates an invalid record or statement material to be presented to the insurance agency with the purpose of receiving the insurance payout for which they are not legally entitled. It is also seen that a defendant intentionally presents a fraudulent or false claim to the insurance company to receive the benefits.

What The Prosecutor Must Prove for an Insurance Fraud Conviction?

In Phoenix, a prosecuting attorney must prove the following things to convict a person in insurance fraud:

Intentionally making a false or misleading statement with the intent to deceive the insurer or unknowingly making a fraudulent or deceptive statement and then did not inform the insurance company of your mistake when you come to know that you made a misleading statement. In other words, it merely means telling a lie to the insurance agency knowingly. For example, if a person claims for automobile insurance by misstating the mileage of his vehicle and then not informing the insurer of the actual mileage of the vehicle when he realizes his mistake.

A fraudulent statement is made by the defendant in connection with a payment or insurance claim to be made under the terms of a policy. This can include exaggerating the claim amount to an insurer or fabricating a false injury to receive a handsome insurance payout or making a false statement by medical service providers to receive a larger claim settlement for the services they performed.

The false statement should be material or significantly crucial to the claim or insurance payout. This can include making a false or misleading statement to an insurance company about receiving the best neighborhood award for the elegance of your home during a robbery claim, which in no way affects your insurance payout for the loss.

What Are The Penalties For Insurance Fraud in Phoenix, Arizona?

According to A.R.S. 20-466.01, insurance fraud is a class 6 felony in Phoenix, Arizona, but the penalties and charges that one will face depend upon the amount of fraud committed and many other factors. Generally, the people convicted of insurance fraud will face imprisonment, fines, restitution, and employment loss. If you are found convicted in extreme fraud cases, you may face ten years of imprisonment, fines up to $150,000 along with the potential civil penalties of around $5,000 for every violation.

In the state of Arizona, the charges for insurance fraud are categorized into 5 degrees, each having a set of penalties upon conviction. Check out the complete breakdown of all those 5 degrees and the penalties:

5th-degree fraud: An illegal gain of an amount less than $1,000 comes under Class A offense, and the defendant could be punished for year imprisonment if convicted.

4th-degree fraud: An insurance fraud for an amount between $1,000 to $3,000 is a Class E felony, and the defendant could be punished for four years imprisonment in jail.

3rd-degree fraud: An insurance fraud for an amount between $3,000 to $50,000 is a Class D felony, and the defendant could be punished for seven years imprisonment in jail.

2nd-degree fraud: An insurance fraud for an amount between $50,000 to $1,000,000 is a Class C felony, and the defendant could be punished for 15 years imprisonment in jail.

1st-degree fraud: An insurance fraud for an amount of $1,000,000 or more is a Class B felony, and the defendant could be punished for 25 years imprisonment in jail.

The important thing to note here is that if an individual has committed an insurance fraud within the preceding five years, he will automatically qualify for fourth-degree fraud. The severity and complexity of an insurance fraud case make it vital for the defendant to seek consultation from an experienced criminal defense attorney who can fight for your rights and freedom.

Possible Insurance Fraud Defenses in Phoenix, Arizona

When it comes to insurance fraud, there is no one-size-fits-all defense approach. Jose A. Saldivar, a professional and well-experienced attorney will investigate the charges levied against you, analyze the possible evidence in your insurance fraud case, and use that information to build a strong defense to bring out the most favorable outcome on your behalf.

Some of the common defenses used by an attorney in insurance fraud case include:

- The alleged false statement given by you was not wholly misleading, though the insurance company was misled by it.

- The alleged false statement was not misleading or untrue at the time it was made (though due to changing circumstances it became false later).

- You had no intention to deceive or defraud the insurance company - you made a mistake - for example, you reported an accidental fire breakout since it was unbeknownst to you, but it was set by someone knowingly.

- A part of your insurance claim was valid, though some part of the value was fraudulent (this defense will not wholly release you against the charges levied against you, but to an extent, it could help in reducing penalties and fines).

What If The Insurance Company (Insurer) Is Trying To Fraud You? Know Where Can You File a Complaint

If you think that the insurance company is trying to dupe you, you can file a written complaint with the Arizona Department of Insurance. You will get the best assistance from this department if the insurer does not settle your claim. To file a written complaint, you need to provide as many details as you can including the name of the insurance company, type of claim, premium amount or any other vital information pertinent to your insurance claim.

Why You Need a Criminal Defense Attorney for Insurance Fraud in Phoenix

If you’ve been charged with, or you are accused of insurance fraud in Phoenix, Arizona, you don't have to wait longer as the clock is ticking and insurance fraud charges in Phoenix may result in hefty fines, imprisonment, loss of work permit or immigration visa, restitution, probation, loss of licenses, a permanent criminal record registered against your name that can impact your chances to get a good job, and many other penalties and charges depending upon the amount of fraud done and the circumstances surrounding the allegations.

It can't be denied that insurance fraud charges are frightening, but it's important to note that a criminal charge does not always equal a conviction. By seeking timely consultation from an expert and hiring an experienced criminal defense attorney to represent your case, you may be able to obtain an acquittal, dismissal, or lesser fines and penalties. Here timely assistance and the right selection of attorney from which you seek advice are crucial to getting the desired result.

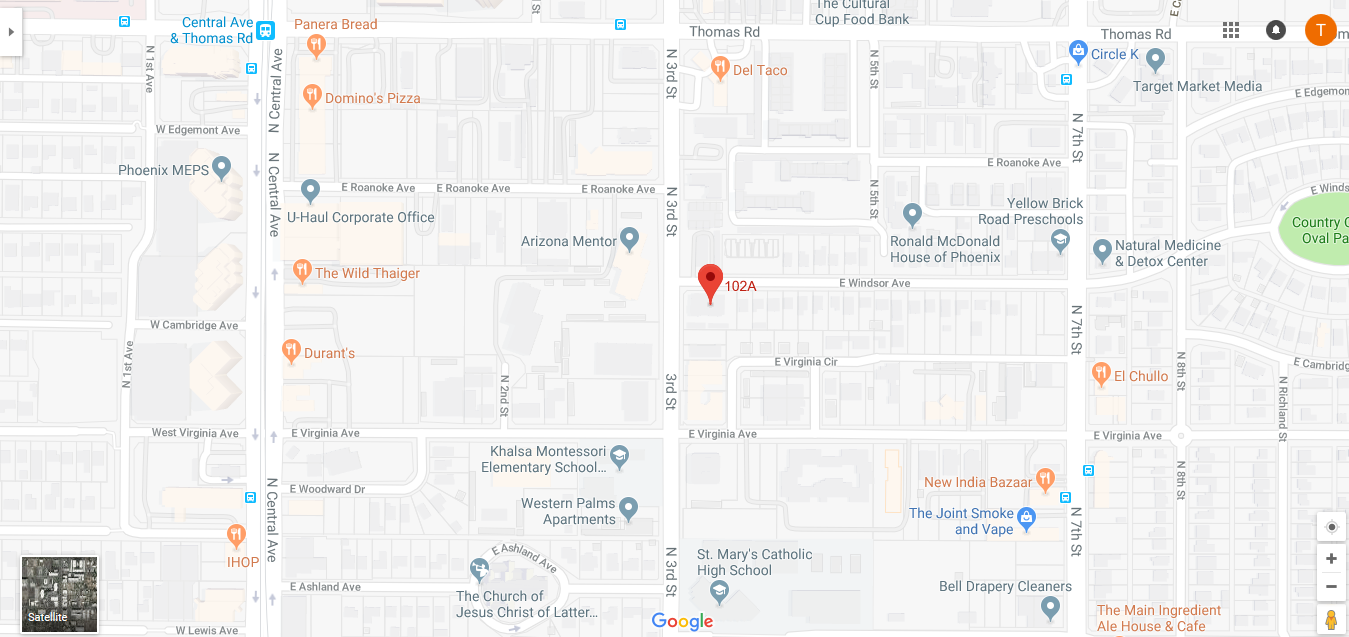

At Phoenix Criminal Attorney Law Firm, we have a team of highly experienced attorneys that help people accused of crimes of different levels of severity. We provide unparalleled criminal defense services and know what to do to defend our clients and win the case if it goes to the court. Our attorneys have sound knowledge of all criminal laws in Arizona and have developed excellent relationships with law officials and enforcement departments across Arizona. To schedule your consultation with one of our attorneys, give our Phoenix criminal lawyer a call at 602-551-8092.