If you are guilty of committing welfare fraud in Arizona, you may face a wide range of penalties. The penalties may include conviction, fines, disqualification from the welfare program, and restitution. You may face fraud charges if you receive benefits that you are not entitled to mainly by lying about your eligibility. You may commit welfare fraud by deliberately misstating facts. You may also commit welfare fraud by failing to disclose some information that would help the government to determine your eligibility for welfare benefits. If you are facing charges for welfare fraud, Phoenix Criminal Attorney can help you come up with a good defense.

Arizona Fraud Laws

In the state of Arizona, fraud crimes are prevalent and may affect many different situations. Fraud is a general term that defines numerous offenses that involve dishonesty and misrepresentation of facts. Fraud also encompasses deceitful behavior and falsified statements. You can commit fraud if you intentionally deceive another person or entity to make a gain or cause damage to that person. You may use fraud to gain something like money, services, or goods from an individual or a government entity by lying. You may lie about a wide range of factors, including your immigration status, your identification details, license number, and other things.

It is common for individuals to commit fraud, especially when buying and selling stock and real estate. They may lie on information like income earned to help them obtain benefits from the state government or the federal government. They may lie to receive benefits, including Medicare and food stamps.

A person may commit fraud in many different settings. For instance, with technological advancement, people are committing fraud on the internet. Your fraud crime may be charged at a state or a federal level. Fraud crimes charged at a federal level may include crimes that cross the state lines and counterfeiting frauds. Fraud charges in Arizona may be criminal or civil. Civil fraud charges apply to fraud cases that revolve around bad faith. The penalties for civil fraud charges aim at restoring the fraud perpetrator to the personal and financial position that he/she was before executing the fraud. On the other hand, criminal fraud charges in Arizona apply if there was intent on the part of the offender.

For a fraud charge to stand in Arizona, it has to fulfill several elements. First, there must have been a misrepresentation of a fact. An entity or a person who is aware that the fact is false must have done the misrepresentation. The misrepresentation should have been to an entity or a person who believes the facts to be true. It must also be evident that a loss or an injury resulted from the misrepresentation.

There are several types of fraud crimes in Arizona. The most common crimes include tax fraud, securities fraud, government fraud, political corruption, unemployment fraud, and identity theft. Other fraud crimes include embezzlement, mail fraud, bank fraud, credit card fraud, and insurance fraud, among others. There are many types of fraud crimes in Arizona, and they range from white-collar crimes to theft charges. Normally, there are three main categories under which fraud cases fall in Arizona. The main categories of fraud include:

Fraud committed against businesses or the government- This category includes certain types of fraud like insurance fraud, tax fraud, healthcare fraud, counterfeiting, bankruptcy fraud, social security fraud, and Medicare fraud, among others.

On the other hand, consumer fraud entails defrauding individual consumers. Fraud crimes that fall under this category include telephone frauds, identity theft, check fraud, credit card fraud, and Ponzi schemes.

Employee Fraud occurs if an employee violates his/her fiduciary duty to the employer and defrauds the company. An employee can defraud the company in several ways, including selling trade secrets, embezzling funds, and accepting bribes.

Arizona Fraud Statute

Section 13-2310 of the revised Arizona statutes cover the crime of fraud. The statute states that any person who knowingly obtains any form of benefit using fraud or using material omission will face class 2 felony charges. Under Arizona statutes Section 13-702, the punishment for a class 2 felony includes imprisonment ranging between 3 years and 12.5 years upon committing a first-time offense. The maximum fine for a fraud crime in Arizona is $150,000.

If you have committed multiple frauds, you may face additional charges for each fraud committed. For instance, if you have forged several checks, you will face more fraud charges than a person who has forged a single check. When you commit fraud in Arizona, you may face federal or state charges. If the fraud qualifies as a federal offense, you will face enhanced charges. Penalties for federal offenses in Arizona are harsher than the penalties for similar offenses prosecuted at the state level. Other penalties for fraud cases in Arizona include payment of the victim's attorney fees. The court may also require you to pay restitution to the victim for the losses that the victim may have suffered due to the fraud crime.

Welfare Fraud

Welfare fraud is a common type of fraud in the state of Arizona. You may face welfare fraud charges if you intentionally misuse the Arizona welfare program. You may commit welfare fraud if you intentionally provide false information or if you intentionally withhold important information. For instance, to receive benefits, you may misrepresent your income. You may also fail to disclose some information about your household members to help you access benefits. You may also commit welfare fraud by faking an illness or an injury to trick the welfare system. You may also assert that you are not in a position to work, while in the real sense, you are perfectly fit to work. The welfare system aims at helping people who need help and not joyriders who want to access benefits, yet they are capable of sustaining themselves. If you commit welfare fraud, you may serve time in jail. You would also have to pay back all the money that the state lost in paying you undeserved benefits.

Elements of Welfare Fraud

What are the elements of welfare fraud under Arizona law? You may face welfare fraud charges if you intentionally and knowingly use false statements, impersonation, representation, or other fraudulent devices to access welfare benefits. The benefits may include a service or assistance to which you are not entitled. You may also face charges for accessing a service or assistance greater than what you deserve. The responsible department has the mandate to disqualify offenders from receiving aid and referring for prosecution people guilty of committing welfare fraud.

You may lose eligibility for participating in a welfare program in several ways. You may no longer be eligible to participate in a welfare program if you sign a waiver of disqualification hearing. You may not be eligible if, after a disqualification hearing, it is evident that you are guilty of committing an intentional violation. The violation may consist of any act or misrepresentation that violates a law governing the welfare program. You may no longer be eligible if you face a conviction for petty offense or any crime against any welfare program.

If you commit an intentional welfare program violation, you may face disqualification from the program for twelve months for a first-time offense. The disqualification will apply even if you were previously eligible to receive benefits. If you commit a second violation of the welfare program, you may face disqualification for up to 24 months. You may face permanent disqualification from the welfare program if you commit three or more violations of the program.

Upon your disqualification from the welfare program, the department will no longer include your needs in the assistance unit. Instead, the department will count your income and your resources as being available to the welfare unit. If you commit a welfare fraud under subsection A of the Arizona statutes, you will face Class 6 felony charges.

Aggressive Prosecution of Welfare Fraud

There are heavy criticism and stigma associated with committing welfare fraud. Abusing the welfare system through deceptive means reduces the funds needed to assist the people with genuine needs. The welfare program is taxpayer-funded. Therefore, when you commit welfare fraud, you inconvenience the taxpayers as well. The taxpayer's hard-earned income goes to the wrong use of to support undeserving individuals because the individuals availed false information about their situation.

In the state of Arizona, welfare fraud is an expensive state predicament. It is for this reason that there is a very heavy prosecution for the crime of welfare fraud in Arizona. The fraud calls for a felony conviction and several years in prison. The issue of welfare fraud has become very severe in Arizona. To help curb fraud, many state governments offer rewards to any person who provides information about individuals involved in defrauding the government.

Examples of Welfare Frauds in Arizona

There are prevalent welfare frauds in the state of Arizona. Despite the government's efforts to curb fraud, there are still cases of welfare fraud. For instance, some people commit welfare fraud by migrating from one district to the other and using different aliases to access state benefits.

It is common for people to defraud the government by lying about the number of children they have. You may claim that you have more children than you have. You may also claim to have children while you have no children at all. Way back in 1981, a woman lied that she had 38 children and defrauded the Arizona welfare system $300,000. The woman was wealthy even before she committed welfare fraud, and she did not deserve to receive any aid from the government.

You may also commit welfare fraud if you fail to report your income or your employment and if you fail to disclose your assets. You may also commit welfare fraud by claiming to be a single parent to enable you to access government support, yet you share a home with the other parent. Other ways of committing welfare fraud include submitting a claim for fictitious children who do not exist or ineligible children. If you use false identification to receive aid, and if you sell food stamps for cash, you may face welfare fraud charges. Another way of committing welfare fraud is by collecting benefits in multiple states.

It is important to note that welfare fraud may target the living and dead people. It is common for criminals to use the personal information of deceased people to apply for benefits. In some other instances, criminals may access information of living people and use it to apply for welfare benefits.

You may face charges for committing welfare fraud, yet you are a victim of identity theft. How can you protect and shield yourself and your family from falling victim to identity theft and consequently facing underserved welfare fraud charges?

Avoid Giving Personal Information –Scam artists may call you pretending to offer government benefits. You should beware of benefits scams because the criminals only have one aim; to access your personal information leading to identity theft. If you receive a phone call and get promises of receiving benefits, it is advisable to hang up the phone immediately. Instead, contact the agency directly if you require any form of welfare benefits. To prevent your phone number from being readily available to scammers, avoid providing your phone contacts, especially on un-authorized websites.

You can also avoid falling victim to scammers by securing your mailbox. Even if you do not receive any form of public assistance, it is still important to ensure that you secure your mailbox. It is common for identity thieves to access government letters and other mails to perform identity theft.

When applying for any form of welfare or public assistance benefits, the social security number is the most important component. It is, therefore, important to ensure that you guard your social security number. Scammers may use your social security number to apply for benefits making you face charges for welfare fraud, yet you are innocent.

Whenever your loved one dies, it is important to report his/her death. Ensure that you notify the social security administration about the death of your loved one. You can make the report through the funeral home upon providing the deceased person's social security number. This way, scammers will not be in a position to use the details of your deceased loved one to commit welfare fraud.

If you usually receive welfare benefits and you happen to misplace your electronic benefit transfer card, it is important to inform the authorities immediately. Ensure that you report to the welfare office. You should also file a report if you come to learn that some funds are missing from your welfare card. Welfare fraud is not only a severe fraud but also a reviled crime. Society hates people who steal funds that low-income families and other people in need may require to survive. If a person a welfare fraud using your information, you will not only face criminal charges but resentment from society. You will have a hard time trying to clear your name.

Welfare Fraud Investigation

If you receive welfare benefits and the welfare department suspects that not all is well, the state may monitor you to determine whether anything has changed. If the welfare department believes that you are not truthful, a fraud investigator may visit your premises. If the investigator finds out that you lied about your income, you may lose your benefits. The welfare department may also charge you with overpayment and require you to return all the benefits received, which you should not have received. If you use fraudulent means to receive benefits that you do not deserve, the welfare department may refer you for prosecution.

Most jurisdictions usually have investigators to detect welfare fraud. Most states also have welfare fraud hotlines that enable members of the public to file an anonymous report of welfare fraud from the comfort of their homes. Members of the society may report to you if they suspect that you are simultaneously receiving benefits from multiple states. You may also be guilty of welfare fraud if you fail to disclose a change in employment and marital status. Using fake identity to obtain welfare benefits or to file for benefits under several names is also a form of welfare fraud.

What if you are accused of defrauding the welfare system, and you did not? You may face this accusation, especially if a member of the society calls the welfare fraud reporting hotline and accuses you of fraud. You do not have to worry. With an experienced criminal defense attorney, you can successfully prove your innocence. The attorney knows the strategies to use to gather evidence and negotiate with the prosecution. Even if you have indeed committed welfare fraud, your attorney may convince the prosecution to alter the charges to reduce the applicable penalties.

Contact a Phoenix Criminal Lawyer Near Me

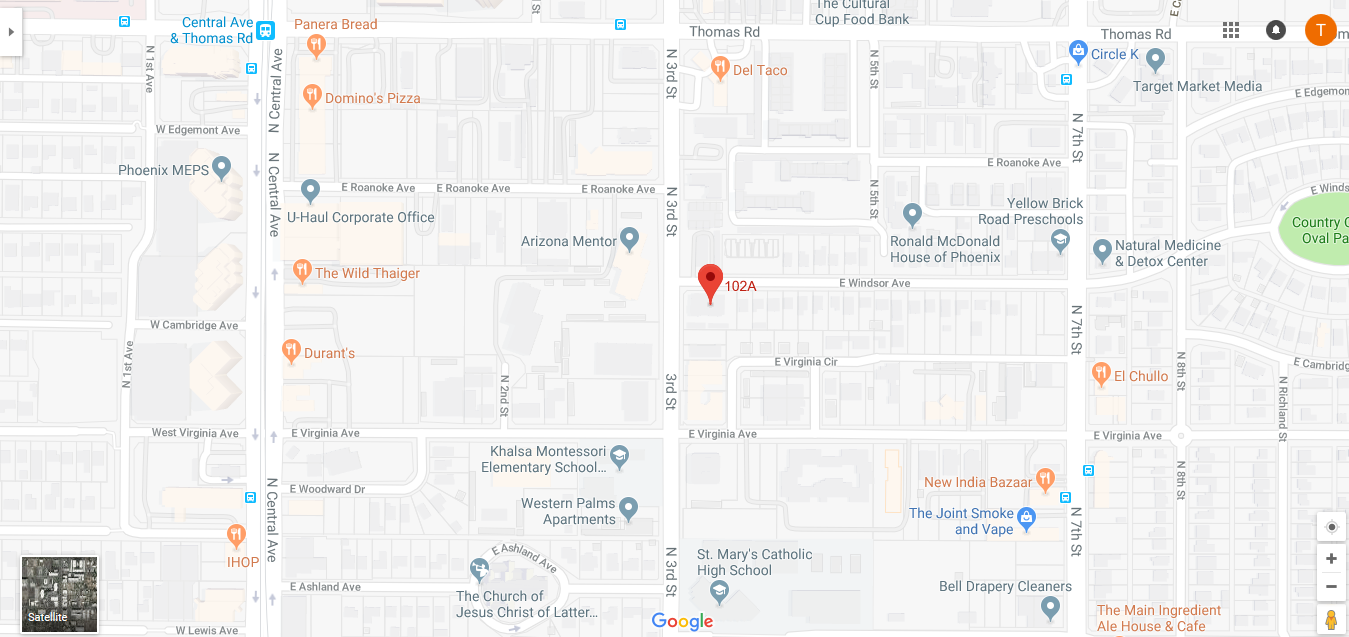

If you are facing welfare fraud charges in Arizona, the associated penalties can be detrimental. To help you fight the charges in court, contact Phoenix Criminal Attorney at 602-551-8092. Our attorneys will evaluate your case and come up with the best defense strategy.

If you are being charged with a crime in Los Angeles check out these law firms: Los Angeles Criminal Lawyer